Retail Portion Of NHAI’s InvIT To Witness Surge: Nitin Gadkari

During early October, InvIT raised Rs 1,430 crore and the issue was oversubscribed around seven times. Nearly 25 per cent of the issue was reserved for retail investors. To pool money from investors and invest in assets in order to provide cash flows over a period of time, infrastructure investment trusts are developed

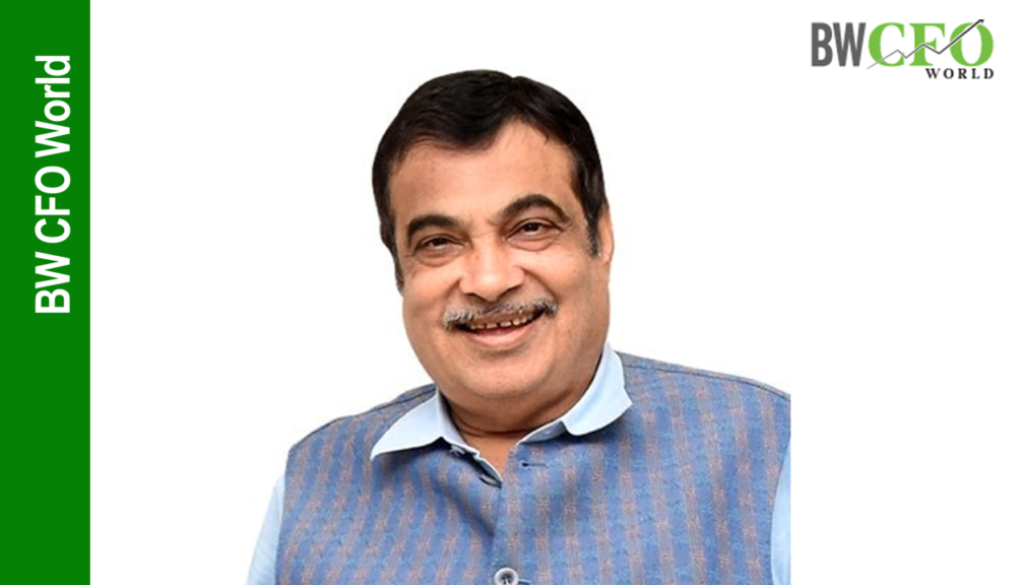

Union Highways Minister Nitin Gadkari, motivated by the overwhelming retail investor response to the recent Infrastructure Investment Trust (InvIT) from National Highway Authority of India (NHAI), said that the retail portion will surge in new such fund-raising ahead, on 28 October. The investment comprised of issuance of Non-Convertible Debentures (NCDs) worth Rs 1,430 crore.

The minister after listing the second share of the NHAI Infrastructure Investment Trust (InvIT) and Non-Convertible Debenture, addressed a gathering at Bombay Stock Exchange (BSE). During early October, InvIT raised Rs 1,430 crore and the issue was oversubscribed around seven times.

Nearly 25 per cent of the issue was reserved for retail investors, however NHAI did not respond on how many times the retail portion was oversubscribed. It rather said that it had an overwhelming response.

To pool money from investors and invest in assets in order to provide cash flows over a period of time, infrastructure investment trusts are developed. Such instruments work on the lines of mutual funds.

The minister without quoting any numbers said, more investment is required from general public in these InvITs and more specifically in our roads. He assured that NHAI’s roads offer 100 per cent security to investors with best internal rate of return (IRR). Moving ahead will fetch more portion being reserved for retail, he added.

NHAI chairperson Alka Upadhyaya also retreated the minister and said that the upcoming InvITs from the NHAI will help more units being reserved for retail, however she did not quote any number.

While addressing the gathering, Gadkari also said that the as of now InvIT has raised nearly Rs 8,000 crore from foreign and domestic institutional investors. However, the second share was special because 25 per cent of the NCD had been reserved for retail investors.